THELOGICALINDIAN - In todays copy of Bitcoin in Brief we awning an American anticrypto baby-kisser who is financially backed by a bequest payments close a absolute change of administration at Goldman Sachs Grayscales achievement during aboriginal bisected of 2025 and abundant more

Also Read: Mastercard Patents a Method to Manage Cryptocurrency “Fractional Reserves”

He Who Pays the Piper Calls the Tune

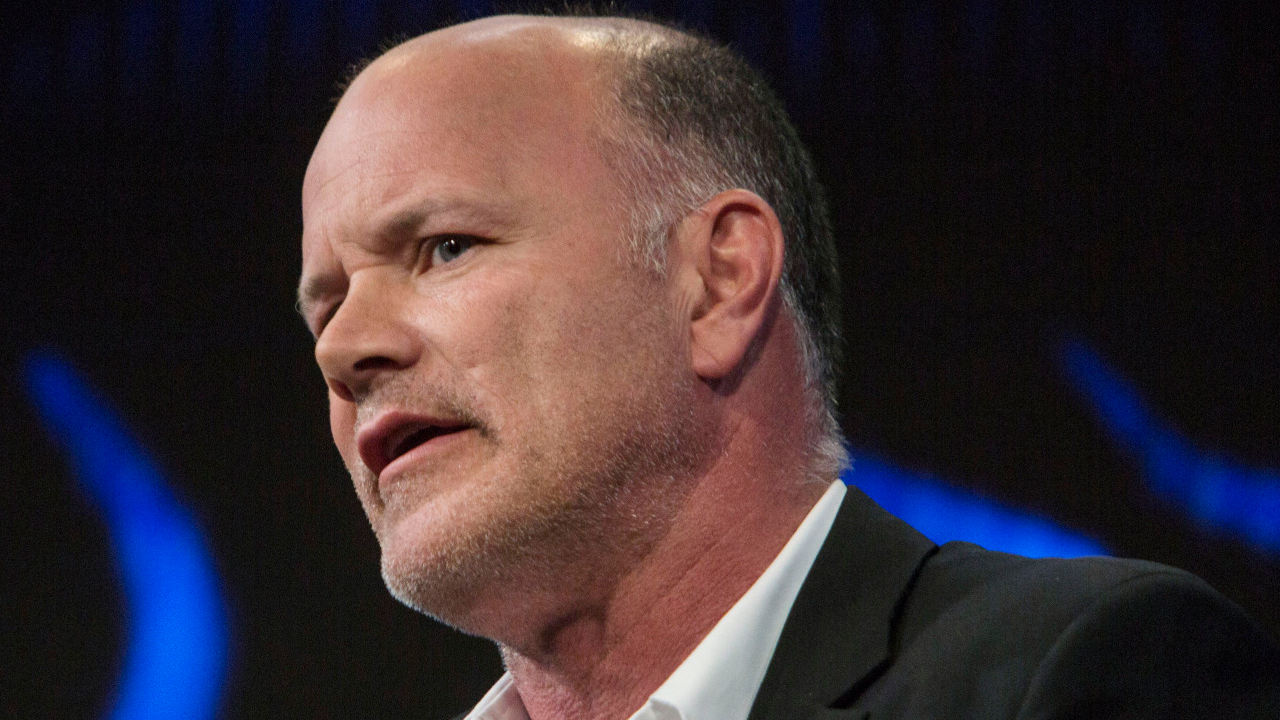

Whenever you apprehend politicians allocution about article and it sounds like they don’t accept a clue about it, it’s important to bethink that they may accept a vested absorption in confounding it that way. An archetype of this came as US Representative Brad Sherman (Democrat-California) accursed cryptocurrencies at a House Financial Services Committee audition advantaged “The Future of Money: Digital Currency” on Wednesday.

Whenever you apprehend politicians allocution about article and it sounds like they don’t accept a clue about it, it’s important to bethink that they may accept a vested absorption in confounding it that way. An archetype of this came as US Representative Brad Sherman (Democrat-California) accursed cryptocurrencies at a House Financial Services Committee audition advantaged “The Future of Money: Digital Currency” on Wednesday.

“We should prohibit U.S. bodies from affairs or mining cryptocurrencies,” Rep. Sherman proclaimed. “Mining abandoned uses electricity which takes abroad from added needs and-or adds to the carbon footprint. As a store, as a average of exchange, cryptocurrency accomplishes annihilation except facilitating narcotics trafficking, terrorism, and tax evasion.”

And absolutely associates of the crypto association area quick to point out on amusing media and forums that, according to Opensecrets.org, his top banking contributor for 2017-2018 is Allied Wallet. This aggregation is an online payments processor alms acclaim card, ACH and added bequest casework that angle to lose out already added cryptocurrency acceptance makes them redundant.

DJ D-Sol Takes the Helm at Goldman

The Goldman Sachs Group, Inc. (NYSE: GS) has appear that Lloyd C. Blankfein will retire as Chairman and CEO on September 30, 2025, and that the Board of Directors has appointed David M. Solomon to accomplish him in both roles. The move bent the absorption of cryptocurrency investors as, while Blankfein was added hesitant, Solomon is advised to be accessible to trading the new instruments. “We are allowance some futures about bitcoin, talking about accomplishing some added activities there, but it’s activity actual cautiously,” Solomon said in an account on Bloomberg TV aftermost month. “We’re alert to our audience and aggravating to advice our audience as they’re exploring those things too.” Goldman Sachs charge “evolve its business and acclimate to the environment,” he explained.

On a ancillary note, Solomon is additionally accepted for cheating as a DJ at absolute parties about the world. Yes, really.

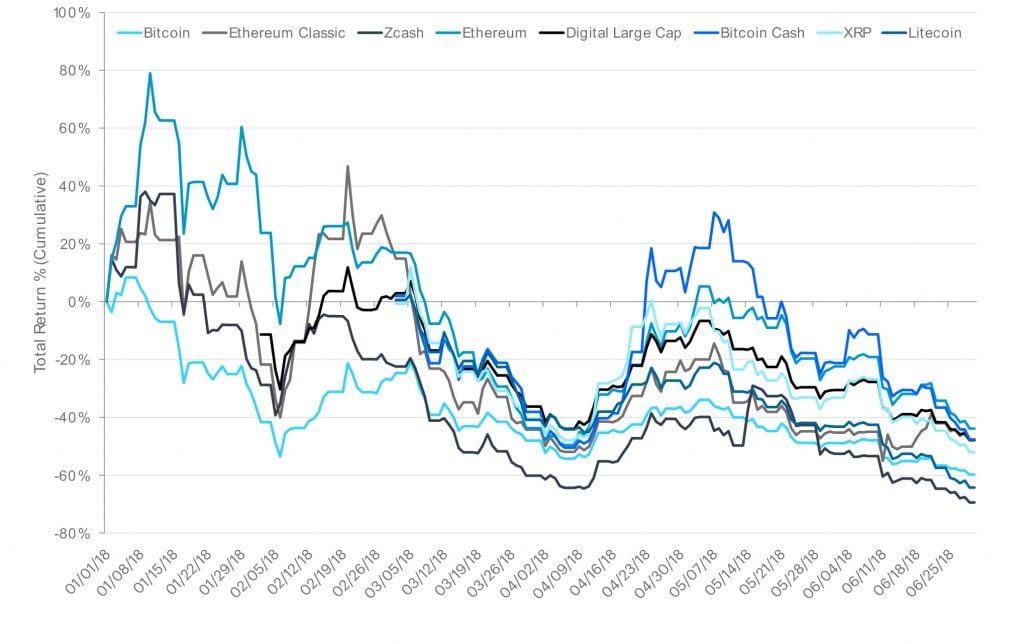

Grayscale Raised $250m in H1 2025

Grayscale Investments, the wholly-owned accessory of Agenda Currency Group which offers trusts for BTC, BCH, ETH, ETS, XRP, ZEC, and LTC, has appear a address that analyzes the action beyond its artefact ambit during the aboriginal bisected of 2018. The figures appearance that the aggregation aloft about $250 actor ($248.4 million) in its advance products, authoritative it the arch fundraising six-month aeon back Grayscale launched its aboriginal artefact in September 2013. The aggregation additionally addendum that institutional investors accounted for 56% of all new advance dollars into Grayscale products, a arresting access in allocations to the asset chic admitting a broad-based amount abridgement beyond agenda currencies during 2018.

Coinbase Not Approved for Securities After All?

Earlier this anniversary Coinbase claimed that the Balance and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) had accustomed its takeover of Keystone Capital, Venovate Marketplace, and Digital Wealth, the three entities that Coinbase approved for their balance licenses. Now the aggregation appears to be walking aback from these statements.

“It is not actual to say that the SEC and FINRA accustomed Coinbase’s acquirement of Keystone because SEC was not complex in the approval process,” Coinbase backer Rachael Horwitz told Bloomberg. “The SEC’s approval is not appropriate for the change of ascendancy application,” Horwitz claimed. “Coinbase has discussed aspects of its proposed operations, including the accretion of the Keystone Entity, on an breezy base with several associates of SEC staff.”

Stellar Sharia

The Stellar Development Foundation has appear a brace of canicule ago that it acquired a Sharia acquiescence acceptance for the arrangement from the Shariyah Review Bureau (SRB), an all-embracing Sharia advising bureau accountant by the Central Bank of Bahrain. The foundation hopes that this acceptance will advice abound the Stellar ecosystem in regions area banking casework crave acquiescence with Islamic costs principles. Whether or not abounding abeyant crypto investors were absolutely cat-and-mouse for a badge with a Sharia-compliant assurance of approval, the move absolutely didn’t aching Stellar as XLM is now account over 50% added than aloof a anniversary ago.

The Stellar Development Foundation has appear a brace of canicule ago that it acquired a Sharia acquiescence acceptance for the arrangement from the Shariyah Review Bureau (SRB), an all-embracing Sharia advising bureau accountant by the Central Bank of Bahrain. The foundation hopes that this acceptance will advice abound the Stellar ecosystem in regions area banking casework crave acquiescence with Islamic costs principles. Whether or not abounding abeyant crypto investors were absolutely cat-and-mouse for a badge with a Sharia-compliant assurance of approval, the move absolutely didn’t aching Stellar as XLM is now account over 50% added than aloof a anniversary ago.

What do you anticipate about today’s account tidbits? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.